Nexa tokenomics was initially proposed to Bitcoin as ‘bits’ on May 2, 2014, by Andrew Clifford (solex), the current president of Bitcoin Unlimited.

Original initial proposal link:

https://bitcointalk.org/index.php?topic=592691.0

It is strategically structured to be direct value to the Nexa ecosystem and support exponential growth, supply schedule mirrors directly to Bitcoin’s.

Why did we choose this model?

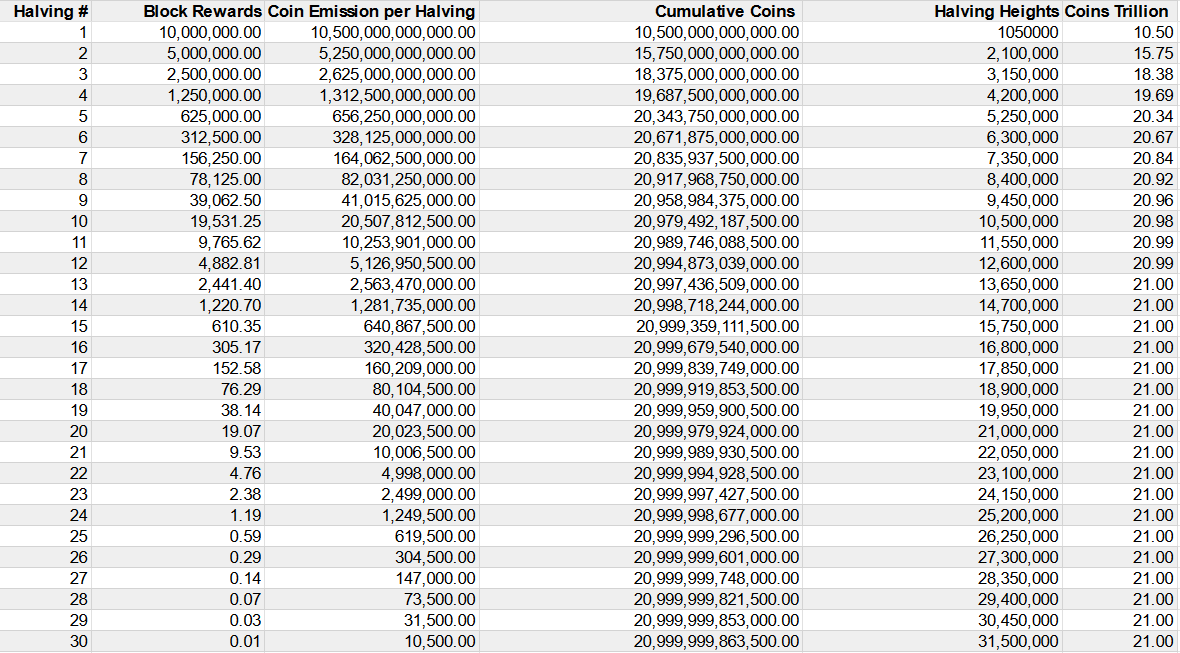

Max supply = 21T

Issuance = 2.4T 140 Years for full issuance

Halvening = Every 4 years

1st Halvening = June 2026

Current block reward = 10M

Nexa Block time = 2 minutes

Schedule Mirrors Bitcoin

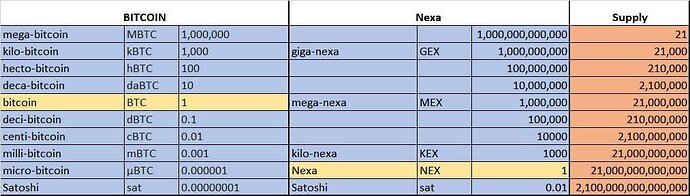

Nexa will only ever have 21T and each Nexa can be divided into 100 parts. Nexa release schedule is carefully calculated, max supply won’t be reached for 140 years This provides enough supply for the world’s economy even when all 8 billion of us are using it.

Nexa is a financial blockchain created to support and facilitate a new digital economy. It’s capabilities is vast, and Nexa is direct value and use case to the ecosystem.

2.1 quadrillion (2,100,000,000,000,000) satoshis will have been mined in roughly 140 years time.

Why Trillion of coins? Great question we hear, that has a fairly simple answer: The supply is the same as Bitcoin in Satoshis, but bigger supply in our primary trading unit to only have two decimal places. This a thought out and calculated decision. We will never deal with sub 2 decimal values of Nexa (similar to fiat) is designed to stay at lower price value compared to USD so that when people transact with Nexa you are doing it in whole round numbers.

We only have two decimal points, for instance, you could buy a cup of coffee with 500 Nexa, not something like 0.00018 BTC

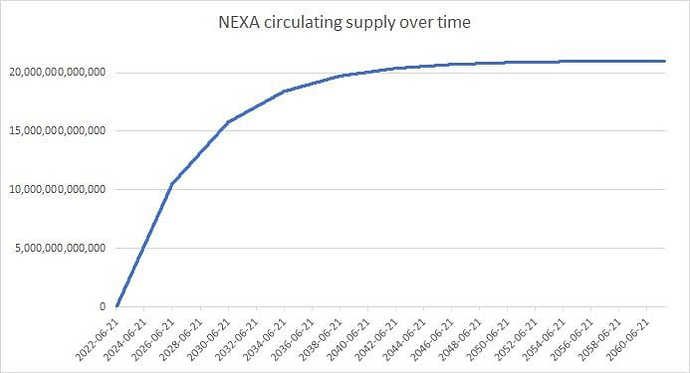

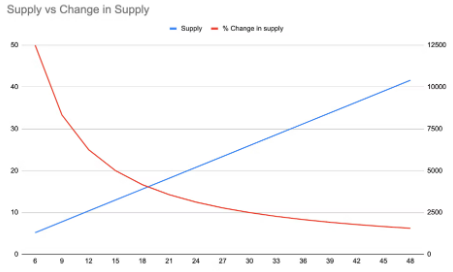

Circulating supply over time shown in a graph:

Although the economics are actually quite different in-terms of the planned velocity of money and demand, people ask isn’t there a load of Nexa being minted right now compared to how much has already been mined?

Well, let’s look at the numbers and the context of the network.

As per todays date, roughly 4.7T Nexa is in existence and every year until the first halvening there will be roughly 2.6 trillion new Nexa coins mined per block, 10 million Nexa are released as the block reward and these are published to the network roughly every 2 minutes.

One way to look at this is, ‘in the next 3 months, what percentage of Nexa will be mined compared to all previously mined Nexa’s. This will give us a picture of how the supply will change relative to the existing supply over time.

Have a look at this graph:

As can be seen from this graph, the percentage change per 3 months decreases rapidly over time from 50% now to about 6% in about 4 years time. This would feed the argument that currently a lot of new coins are being minted. Remember, in the chart above we are just looking at supply. Another factor is demand. It’s important to keep in mind that Nexa being very new, means it has only reached a very small number of people so far. What that means, is that we see the same (but opposite) dynamic in terms of new users and demand. Growth comes with community.

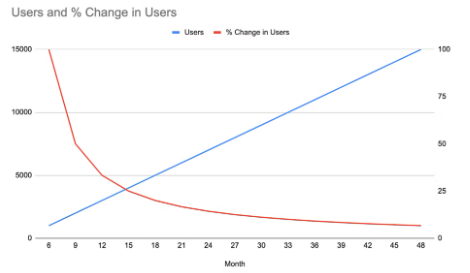

The graph below shows what happens with community growth at a linear rate from 2,000 members to 15,000 members in about 4 years from launch.

These are hypothetical numbers, we are exceeding these numbers at a rapid pace.

You can see that the chart looks identical, but this is not what we are aiming for. This is very conservative. We aim to leverage the community and our resources to reach ever larger numbers of people to grow the network rapidly.

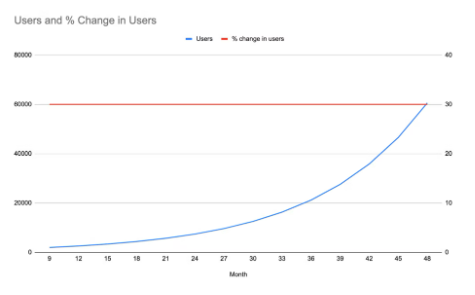

This chart looks very different…

This chart is what we are really aiming and positioned for massive, exponential growth like we have seen with Bitcoin. But there is a huge factor that is missing in the above models, and that is price. Price itself places a huge role in how the supply affects the… price. Yes, that’s the true complexity of economics creeping in.

The price recursively impacts the price.